Teach Your Children How to Save

The belief of teaching children about the concept of money is different for everyone. Some people believe that teaching young kids about money isn’t a good idea as it is confusing. Whereas, others believe the younger they learn to save, the better.

The most common age people think children should start learning about money is around the age of 4. Although this sounds really young, most children at the age of four will understand that things cost money. For example, they will be able to tell if their friend has a better toy than them and understand it might cost more money. But, kids probably won’t understand the concept of money until around the age of 8/9.

Here are three tips on how to teach your children about saving money:

1. Save Using Jars

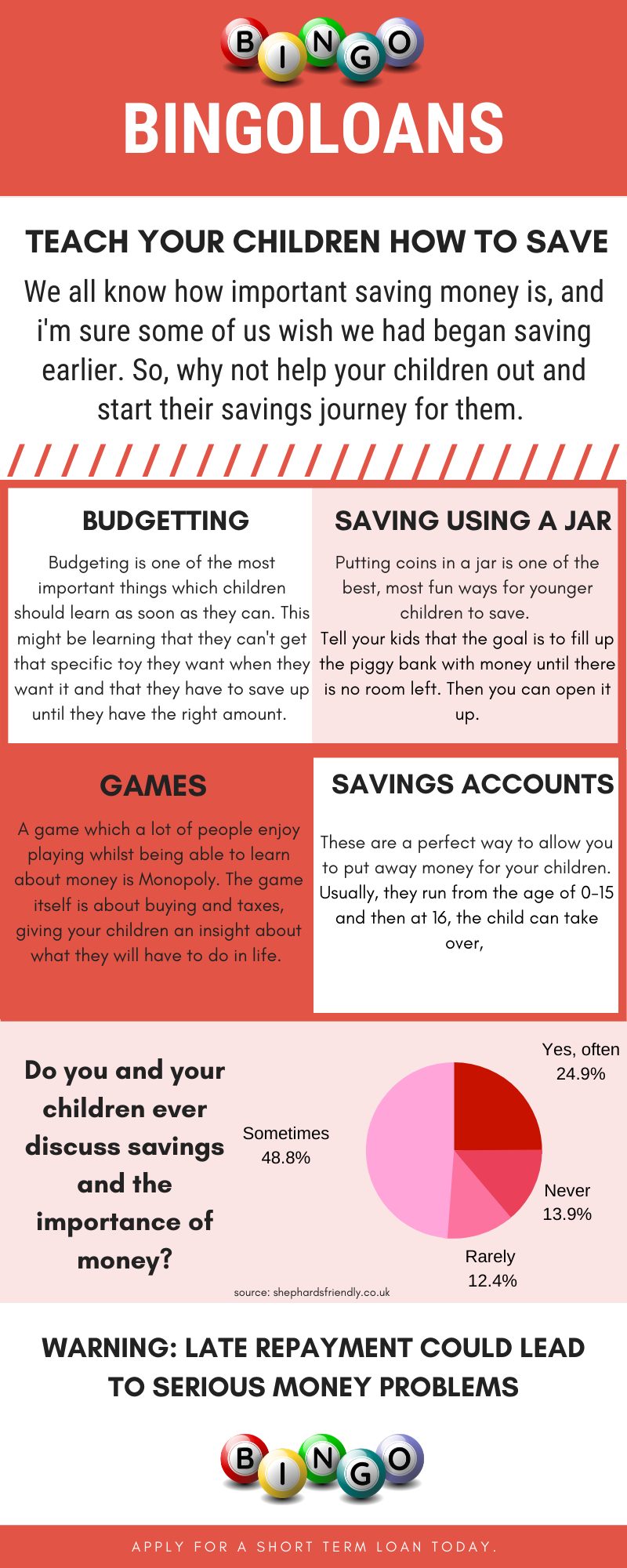

Putting coins into a jar or a tub is one of the most popular ways of teaching to save. Young children will enjoy getting some coins and putting them away in a jar, showing them that saving money is fun. Meaning they will want to continue saving money and by the time they are older, they will have a decent amount of money saved up.

2. Incorporate Games

A good idea is to play certain games which allow you to include money. A popular game which younger children enjoy is to play with plastic fruit and vegetables. This is a common thing for children around the age of 2-4 to like. If you’re playing with them, you could use coins or pretend notes to swap for something in exchange to teach them that things cost money. They will be able to understand that they can’t get an item if they don’t have any money for it.

3. Spending and Saving Apps

Having their own savings account makes children more money aware and can encourage them to develop good savings habits as grown-ups. They are a great idea for your children to be able to save whilst they are too young for their own pocket money. Banks like Halifax and Barclays offer kids monthly saving account from 0-15 years (Barclays is up to 17). This allows people to put money into a bank account for their children from a young age.

Other Advice

Don’t forget that it is never too late to start saving, whether you’re 18 or 50. There are multiple ways which you can save a small amount or even a large amount. Whether it be through a savings account or even an app.

Related: Top 3 Money Saving Apps.

As a parent/carer you may experience some difficult financial situations throughout your life, but don’t worry because we are here to help! We offer short term loans and payday loans up to £1,500 to help you through the harder times.